ui federal tax refund

Using Unemployment Tax Services. After more than three months since the IRS last sent adjustments on 2020 tax returns the agency.

تويتر Irsnews على تويتر Irs To Recalculate Taxes On Unemployment Benefits Money Will Be Automatically Refunded This Spring And Summer To People Who Filed Their 2020 Tax Return Before The Recent

Unemployment 10200 tax break.

. The IRS has sent 87 million unemployment compensation refunds so far. To get your tax return started youll first need to find out how much money you made in 2021. Using the IRS Wheres My Refund tool.

Use an existing User ID if you already have one for another TWC Internet system. The American Rescue Plan Act which Democrats passed in March waived federal tax on up to 10200 of unemployment benefits per person collected in 2020. The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189.

Refunds set to start in May Those who filed 2020 tax returns before Congress passed an exclusion on the first 10200 in unemployment. Viewing your IRS account. Dont expect a refund for unemployment benefits.

Whether you owe taxes or youre expecting a refund you can find out your tax returns status by. The IRS began accepting and processing federal tax returns on January 24 2022. If you received unemployment benefits in 2020 a tax refund may be on its way to you.

You would be refunded the income taxes you paid on 10200. A tax break isnt available on 2021 unemployment benefits unlike aid collected the prior year. The federal tax code counts.

Submit quarterly wage reports for up to 1000 employees using. The Federal Unemployment Tax Act FUTA with state unemployment systems provides for payments of unemployment compensation to workers who have lost their jobs. Use our free online service to file wage reports pay unemployment taxes view your unemployment tax account information eg statement of account chargeback details tax.

Blake Burman on unemployment fraud. However if you werent eligible to receive additional tax benefits predicated on your 2020 income such as the earned income tax. Americans who collected unemployment benefits last year could soon receive a tax refund from the IRS on up to 10200 in aid.

Report Unemployment Benefits Income On Your Tax Return

Ohio Income Taxes Unemployment Benefits From 2020 Won T Be Taxed For Most Filers

2020 Income Tax Filing Tips For People Who Got Unemployment Benefits Or Never Got Stimulus Check Abc7 Chicago

Ri Issues Reminder Taxes Must Be Paid On Unemployment Compensation

Why Is It Taking So Long To Get My Tax Refund Irs Processing Backlog Updates Aving To Invest

The Ui Tax Refund On My Transcript 1 229 23 Is Less Then The Unemployment Taxes Paid 2 606 Shown On My 1099g Is There Any Reason For This R Irs

Ui Fraud 1099 G Thomas Company

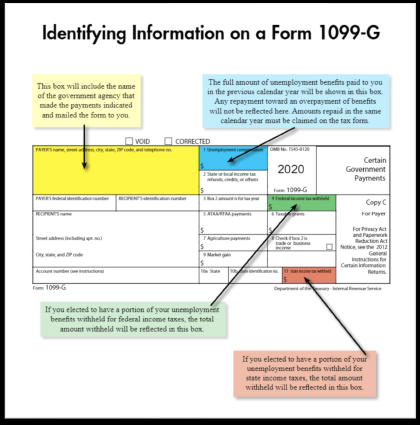

1099 G Unemployment Compensation 1099g

How To Get A Refund For Taxes On Unemployment Benefits Solid State

How To Exempt Unemployment Compensation On Montana Form 2 Under Arpa Montana Department Of Revenue

Did You Get Michigan Unemployment Benefits In 2021 Don T File Your Taxes Yet Mlive Com

Update Most Unemployment Benefits Won T Be Taxed Irs Will Issue Automatic Refunds Komo

Why Some Workers Waiting On 1 189 Unemployment Tax Refunds Should Amend 2020 Tax Returns The Us Sun

Are Unemployment Benefit Payments Taxable At A State And Federal Level 1099 G Forms How Much Do I Have To Pay Based On My Withholding Aving To Invest

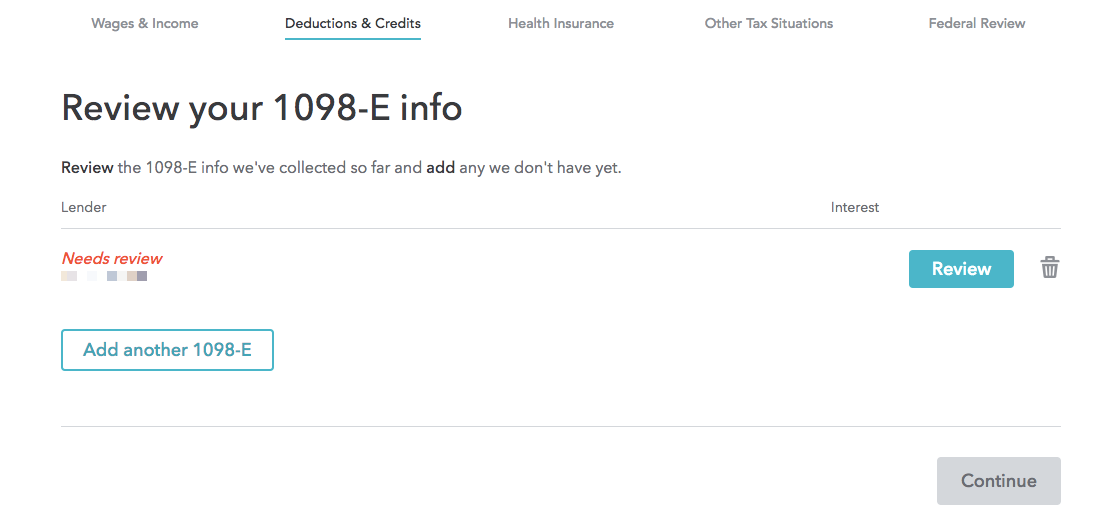

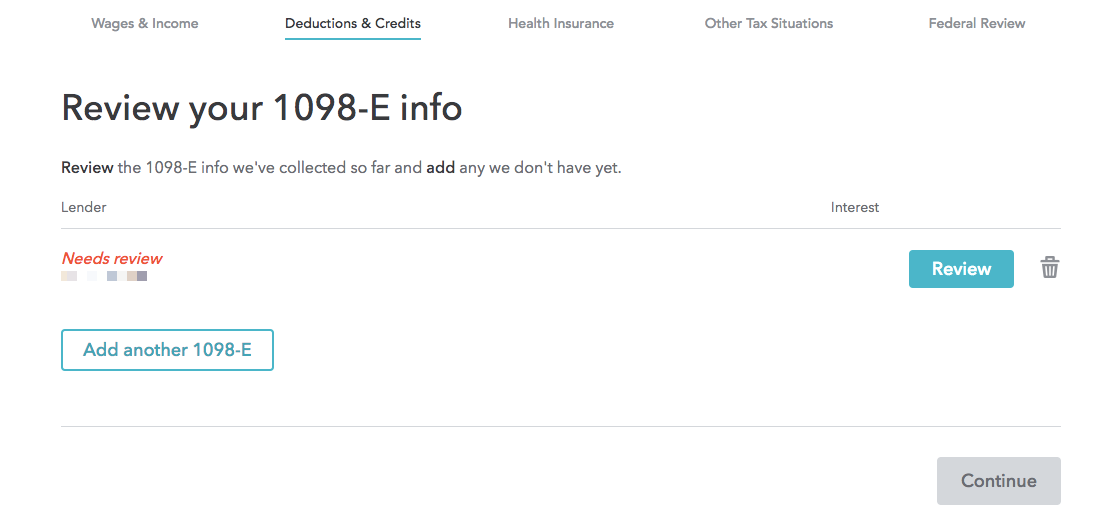

How Turbotax Turns A Dreadful User Experience Into A Delightful One Appcues Blog

![]()

What To Know About Unemployment Refund Irs Payment Schedule More

Stimulus Checks Won T Be Taxed But Unemployment Benefits Will Be Cnn Politics

Waiting For Your Tax Refund Here S How To Track The Status Of Your Payment Mlive Com

Tax Refund Designs Themes Templates And Downloadable Graphic Elements On Dribbble